The housing market is showing signs of steady recovery, with mortgage rates dropping to their lowest point in 15 months and house prices on the rise. The latest data from our House Price Index highlights some key trends shaping the market today, from increasing home sales to modest price inflation.

UK House Prices and Market Activity

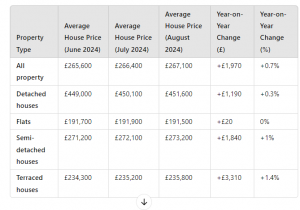

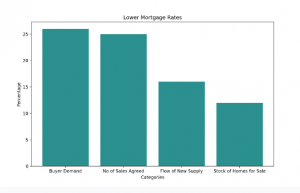

According to August,2024 analysis property price reached upto £267,100, according to August 2024 analysis. Although annual house price inflation is currently at 0.7%, it is expected to rise to 2.5% by the end of the year, marking a slow but positive recovery in house values. The shift in market dynamics, driven by lower mortgage rates and higher buyer demand, has resulted in a 26% increase in homebuyer activity compared to this time last year.

This increase is mainly driven by falling mortgage rates, as the average rate for a 5-year loan with 75% loan-to-value dropped to 4.3%, down from 5.5% a year earlier. This is the lowest rate since May 2023, and lenders are fiercely competing to offer buyers attractive deals, particularly those with substantial equity. This competition is encouraging more households to make the move they may have postponed during the economic uncertainty of the last two years.

Sales Surge Across the Country

Sales agreed across the UK have surged by 25%, with a significant rise in areas like the East Midlands and North East, where sales have climbed by over 30%. Nationally, sales are up by over 10% from last year, more homes are being put on the market, which, combined with growing buyer confidence, is driving the recovery in the housing market.

However, despite these promising figures, house price inflation remains sluggish. Affordability constraints, particularly in southern regions of England, are limiting price growth. Southern areas like the South West, South East, and East of England are still reporting lower house prices compared to last year, but the national picture shows gradual improvement, with prices up 0.7% year-on-year.

Price Growth in Key Regions

Interestingly, Northern Ireland has outperformed much of the UK, with house prices rising by 5.5% after lagging behind the market in recent years. London, too, has seen a significant shift, with prices bouncing back from a 1.7% annual decline to a modest 0.5% increase today.

More homes on the market are also helping to keep price inflation in check. The supply of homes for sale has grown by 12% compared to last year, with many sellers motivated by the potential for tax changes that could affect property owners with multiple homes. Consequently, buyers are becoming more cautious about pricing, prompting sellers to reassess their listing prices.

Tax Change Speculation Boosts Market Supply

The upcoming Budget has created speculation that further tax changes could encourage more supply. Investors and second-home owners, in particular, are reconsidering their portfolios, which has increased the number of chain-free homes on the market. Around 32% of homes listed for sale are chain-free, with one and two-bedroom flats being common outside London, and two and three-bedroom houses more popular in London.

Landlords, too, are feeling the pressure of higher mortgage rates, especially in London and the South East, where low house price growth has impacted their returns. This has led to more rental properties being listed for sale, further boosting market supply.

Looking Ahead: A Steady Road to Recovery

The housing market outlook is cautiously optimistic. While house price growth remains modest, a combination of rising sales volumes and competitive mortgage rates is supporting a steady recovery. Sellers are eager to get the best price for their homes, but buyers are being more cautious.

The good news for buyers is that mortgage rates are expected to remain attractive, potentially dipping below 4% in the coming months as financial markets anticipate lower UK interest rates in the next 2-5 years. This, combined with rising household incomes, should improve affordability and continue to drive market activity.

The recovery may be slow, but with sensible pricing strategies, both buyers and sellers can find opportunities in today’s evolving market. As always, realistic expectations on pricing will be key to achieving timely sales and making the most of the market’s potential.